Why use a finance broker?

When you are considering finance in the UK, whether for a business loan, asset purchase or another form of borrowing – navigating the market and choosing the most suitable finance can be complex. That’s where a finance broker can provide significant value. What is a finance broker? A finance broker acts as an intermediary between […]

Solar Financing

Commercial solar installations present large upfront costs. From companies looking to offer finance to their customers, to businesses looking to finance their own solar installation, here’s a guide to help simplify commercial solar financing. What Finance is Available For Commercial Solar? Solar Leasing Under a solar lease, your business will rent the solar equipment for […]

Padel Court Finance

With its stratospheric rise in popularity, padel courts are being developed in numbers across the UK. Industry growth has enticed investors and lenders alike, as the commercial potential of the sport continues to swell. At Mill Wood Finance, we specialise in sourcing the most suitable finance for Padel Court Developers. Our 30 year expertise in […]

Bridging Loans For Property Development

Bridging Loans for Property Development: What Are Your Options? In the fast-moving world of property development, timing is of paramount importance. Whether you’re converting a property or undertaking a ground-up build, access to the right funding at the right time can make or break your project. Bridging loans offer a flexible, short-term financing solution for […]

Nursery Franchise Finance

Nurseries present a sensible investment opportunity, providing a steady income stream and continuous adoption of new customers (so long as people keep having children…). From acquiring new sites, to large-scale development projects, we help childcare and specialist education businesses access the funding they need to grow. If you are looking to fund the purchase of […]

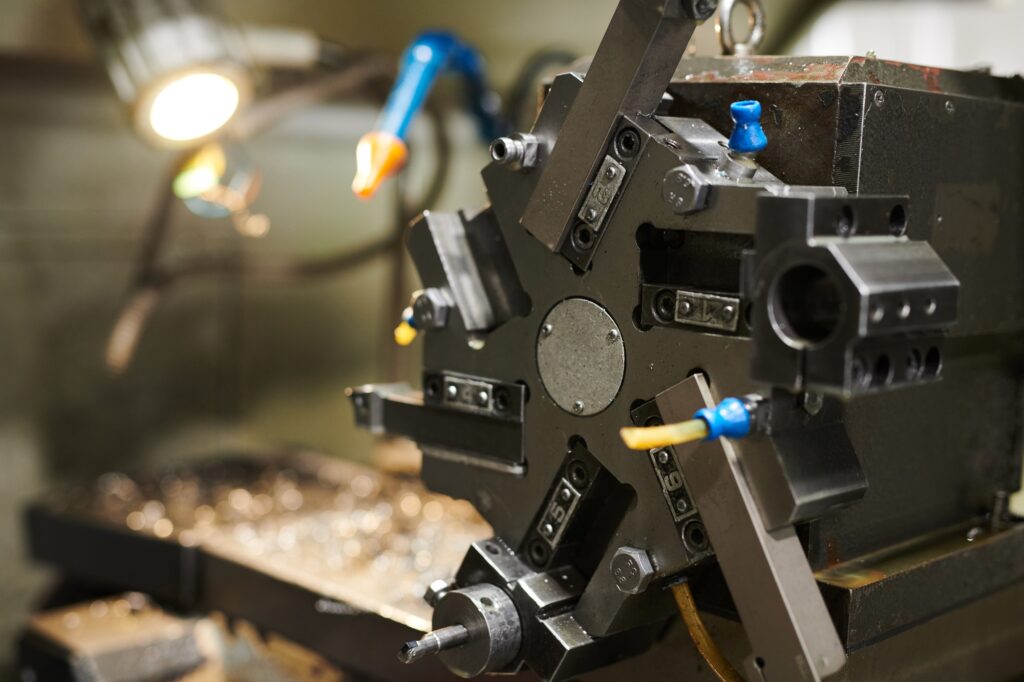

Construction Firms: Asset Refinance

In the ever-evolving construction industry, maintaining a healthy cash flow is as crucial to your operation as laying the correct foundation. Without your cash flow in good shape, you may be unable to take advantage of timely commercial opportunities. With rising materials costs, the industry has had to challenge previously successful traditions and change the […]

Unlocking Hidden Value: Which Assets Can You Refinance?

In today’s competitive and time sensitive commercial landscape, maintaining a healthy cash flow is crucial in order to take advantage of any timely business opportunities. But what happens when you need to raise capital without taking on new debt or giving away equity? The answer may lie within your business itself; specifically, in the assets […]

Asset Refinance vs Traditional Business Loans: Which is Right for You?

When businesses in the UK seek funding, one of the first decisions they will make is choosing which type of funding suits their business the most. Among the most common finance options are asset refinance and traditional commercial loans. Both routes can be effective tools to improve your cash flow or to fund growth, however […]

Landlord Portfolio Finance

Funding options for property businesses As the UK property market continues to evolve, landlords and property investors are increasingly looking to grow their portfolios to meet the rising demand for rental housing. It goes without saying, scaling a property portfolio can be capital intensive – so many landlords; particularly those operating through a limited company, […]

Petrol Garage Franchise Finance

Exploring Your Commercial Finance Options Investing in a petrol garage can be a highly lucrative business providing stable revenue streams, strong demand and regular customers. However, securing the necessary capital to cover the costs of acquiring and setting up a franchise presents some challenges. Commercial finance provides a practical solution for you to fund your […]