In today’s competitive and time sensitive commercial landscape, maintaining a healthy cash flow is crucial in order to take advantage of any timely business opportunities. But what happens when you need to raise capital without taking on new debt or giving away equity?

The answer may lie within your business itself; specifically, in the assets you already own.

Asset refinance is a powerful financial tool to help you leverage the value in your business’ tangible assets in order to raise capital for many purposes, from supporting expansion plans to providing stability, asset refinance can provide the foundation for your business to flourish.

Let’s explore the most common assets that can be refinanced:

Vehicle and Fleet Assets

If your business owns vehicles such as commercial vans, cars or HGVs, you may be sitting on a significant amount of working capital. Refinancing your vehicle/fleet allows you to release equity tied up in assets while retaining full operational use.

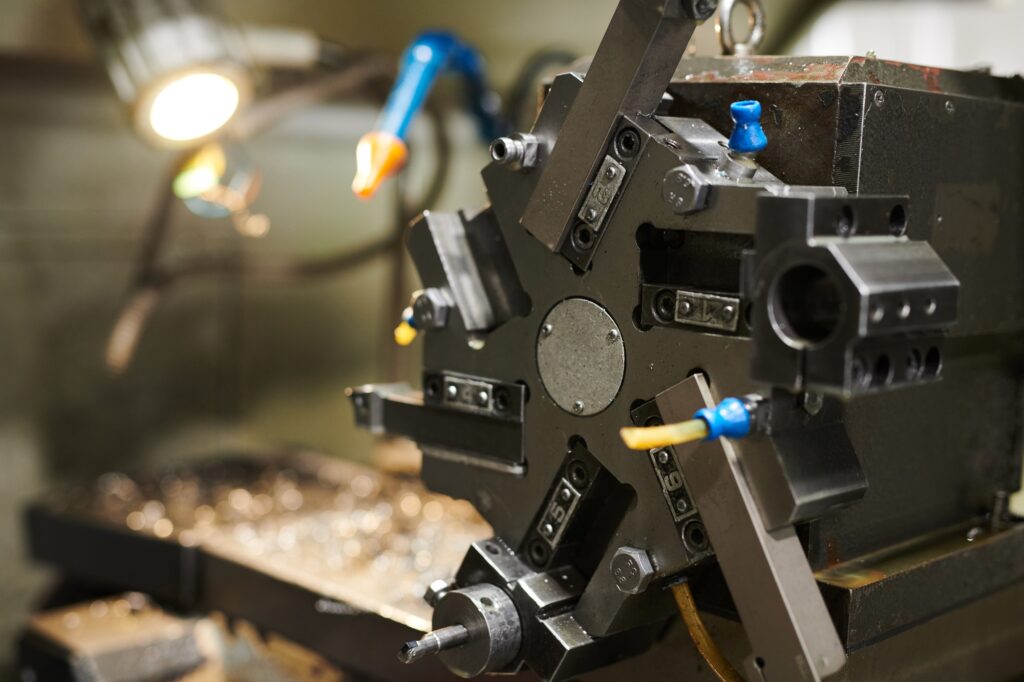

Plant and Machinery

Heavy equipment often represents a significant investment. If you operate in manufacturing, agriculture or engineering, you likely have valuable assets you can release funds from. These funds can be used to purchase new equipment, or to fund business expansion.

Technology and IT equipment

Servers, data centres and specialist computing equipment can all be refinanced. These assets can command a high price, however they are sometimes tricky to provide a valuation for – so it’s important you represent the value of these assets to us so we present these to our lenders we connect you with.

Stock and inventory

Some of our boutique lenders offer stock refinancing, allowing your business to borrow against the value of unsold goods. This is particularly useful for seasonal businesses, or those needing to buy large volumes of stock ahead of demand.

Property

Commercial property refinance is one of the most common forms of commercial asset refinancing. A commercial property represents a huge investment, and if you own your premises, refinancing can help you secure better terms or raise capital for additional investments.

Receivables and invoices

While not a fixed asset, unpaid invoices are considered by lenders as a form of working capital. Invoice finance/invoice discounting enables you to release funds from these unpaid invoices (your accounts receivable) before your customers pay. This can help bridge the gap when cash flow is tight while you wait for creditors to pay.

How the refinancing process works

- Discovery call

You have a discovery call with us at Mill Wood to discuss your requirements, your current assets, and any other important information to support your asset refinance application.

- Asset valuation

Lenders will assess the current market value of the asset(s) you are looking to refinance.

- Loan offer

Lenders will present an offer with an agreed repayment structure based on their valuation of your asset.

- Funds released

The money is transferred to your account, often within days of approval.

- Repayment

You repay over a fixed term, with interest, while retaining use of the asset.

Benefits of asset refinance

- Improve your cash flow without selling assets

- Faster access to capital than traditional loans

- Retain control and usage of your business assets

- Flexible terms tailored to your circumstances

Is Asset Refinance Right For My Business?

Asset refinance isn’t just suited to businesses in distress. It’s a strategic option for companies looking to invest or become more financially agile. Whether you’re upgrading equipment or expanding your premises, leveraging the value in your existing assets could be the launchpad for your business growth.

The Mill Wood Approach

At Mill Wood, we take pride in our process and our intimate relationships with a range of lenders and finance houses. It is our role to be as flexible as possible to help you find the most suitable refinance to allow your business to flourish.

We work with businesses of all sizes across the UK to structure asset refinance solutions, tailored to your business. Whether you’re looking to release cash from a single asset or refinance a number of assets, we can help you access the funding your business needs.

Interested in exploring the finance options available for your business? Get in touch with our team for a free consultation call.